There are trends in the world of loans

Definition of Net Income

Net income is the amount of money a company has left over after all its expenses are subtracted from its revenue.

This includes not just operating costs but also other expenses like depreciation, taxes, and interest. It’s a crucial metric in any business’s income statement, which reveals the company’s earnings over a specific period of time.

Importance of Understanding Net Income

Understanding net income is vital for both business owners and investors as it’s an indicator of the company’s financial health. Net income can also be useful for various business operations, from evaluating staff performance to making investment decisions.

Why Net Income is Important

Understanding a Company’s Financial Health

Net income serves as a key metric for assessing a company’s financial health.

A consistently positive net income indicates a business that’s profitable, whereas negative figures could signal trouble. It helps in calculating other important financial ratios and metrics like earnings per share (EPS) and return on investment (ROI).

Comparing a Company’s Performance to Its Competitors

Net income is also used for benchmarking a company’s performance against its competitors. By looking at the earnings per share or the net income of different companies within the same industry, stakeholders can get a sense of how well a company is doing in the market.

How to Calculate Net Income

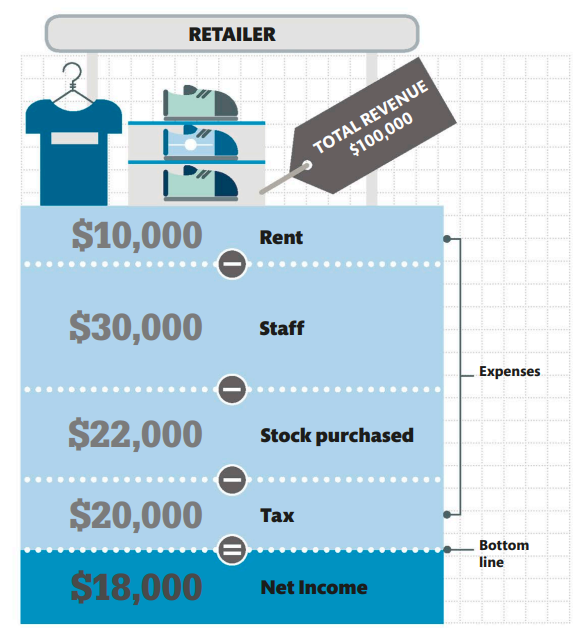

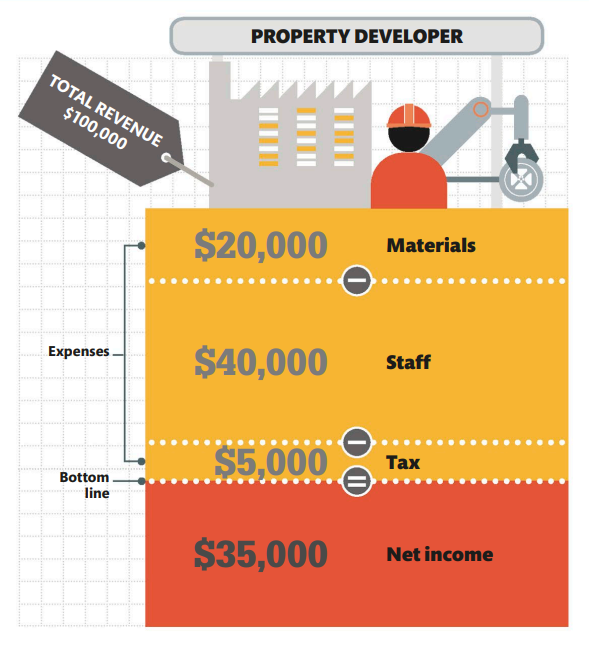

Starting with Revenue

The calculation of net income starts with revenue, also known as sales revenue. This is the total amount of money brought in from the business’s operations, which could include the sale of goods, services, or other business activities.

Deducting Expenses

From revenue, various expenses are subtracted. These include direct costs like raw materials, administrative expenses, and other operating costs. Deductions may also include federal taxes, depreciation, and interest. The income formula for calculating net income is: Net Income = Revenue – Expenses.

Common Issues with Net Income

Companies Omitting Expenses or Inflating Earnings

Net income is not without its issues. Some companies may omit certain expenses or inflate earnings, which can give a misleading impression of their financial health. This kind of manipulation can result in a skewed income statement.

Tesco’s Accounting Scandal

Take Tesco’s accounting scandal, for example, where the company overstated its profits. Such instances underscore the importance of using net income alongside other financial indicators like cash flow statement and balance sheet for a comprehensive view.

Key Terms to Know

Bottom Line

The term “bottom line” refers to the net income, which is essentially the “bottom line” of the income statement, showcasing the company’s profitability.

Earnings per Share

Earnings per Share (EPS) is a key metric that divides the net income by the number of outstanding shares. It is an important figure for shareholders.

Expenses

Expenses are costs incurred in the day-to-day operations of a business, ranging from employee paychecks to administrative costs and raw material purchases.

Depreciation of Assets

Depreciation refers to the decrease in value of assets like machinery and vehicles over a period of time, which is accounted for in the income statement as an expense.

Banking and Interest Charges

These include the costs related to borrowing, such as interest payments, which are also considered when calculating net income.

Real-World Example

Apple’s Net Income in 2016

In 2016, Apple reported a net income of approximately $45.7 billion. This information was crucial for investors, as it reflected the company’s ability to generate profits and maintain a healthy operation. It also helped in the calculation of metrics like earnings per share, contributing to its market share and valuation.

Conclusion

Recap of the Importance of Net Income

Understanding net income is crucial for assessing a company’s financial health and comparative performance. However, it should not be used in isolation and should be evaluated alongside other financial statements and metrics.

Final Thoughts on Using Net Income as a Financial Indicator

While net income is an essential measure, it is vital to consider other financial aspects like cash flow and balance sheet for a holistic view of a company’s performance. Effective bookkeeping and a clear understanding of all these terms can help both business owners and investors make informed decisions.