There are trends in the world of loans

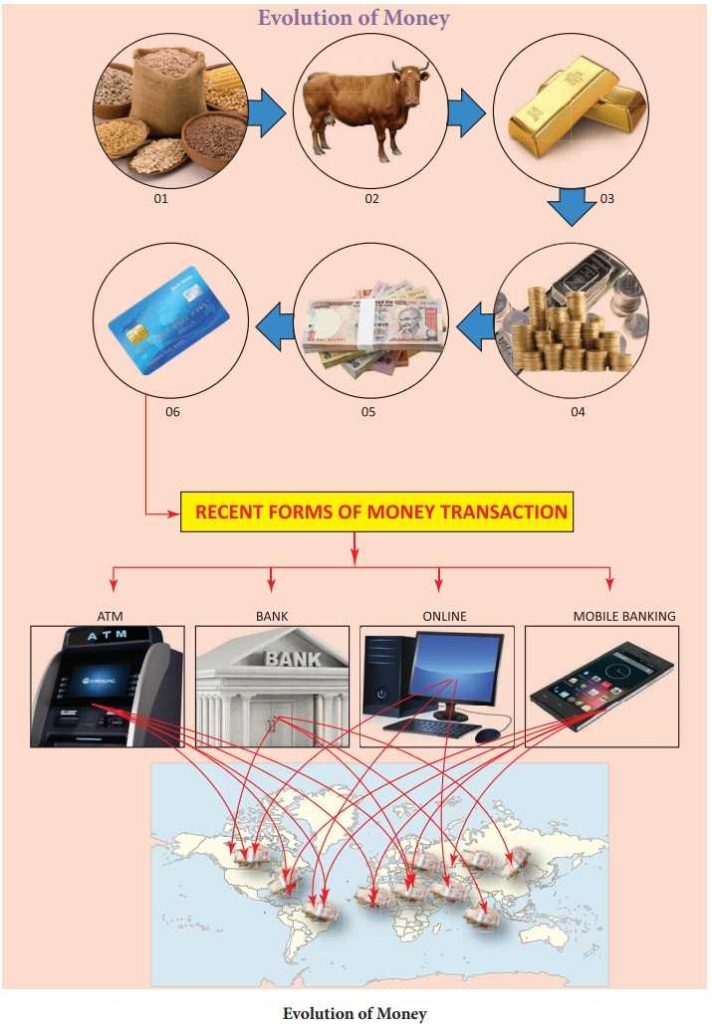

Money, the lifeblood of any economy, has undergone significant transformations over the centuries. While it is easy for us to think of money as coins, banknotes, or even digital currency, such a concept has not always been present in human civilization. In fact, the journey of money is a tale of many revolutionary changes.

Understanding the evolution of money is essential, not only for economists but also for individuals who interact with different forms of money on a daily basis. This article traces the evolution of money from its ancient origins to its present, digital manifestation.

The concept of money originated as a solution to the complications of barter, where goods and services were exchanged directly for other goods and services. Primitive societies assigned value to objects like cattle, seeds, or even stones, which they used as a medium of exchange. Over time, this attribute of value was ascribed to more portable objects such as metals, shells and even paper.

“The discovery of using metals as money was a crucial step in the evolution of currency, making it easier to carry, store and count wealth.”

However, shifts in the economy necessitated further changes in the monetary system. The rise of banks, the advent of paper money and later, the era of digital transactions – all these stages represent the continuing evolutionary journey of money.

Barter, IOUs, and Money

In the history of trade and commerce, three significant steps can be identified: Barter, IOUs and finally, Money. Each phase is an evolution from the previous one and has contributed to the complex global economy we now exist in.

Barter System

- The earliest form of trade was barter, which is the direct exchange of goods and services.The popularity of the barter system majorly depends on the double coincidence of wants, which rarely happens.

- Despite its limitations, the barter system was used for centuries across different societies and cultures around the world.Over time, with the increase in trade and growth in population, barter system grew more complex and harder to maintain.

IOUs

- As a solution to the challenges of the barter system, IOUs emerged.IOU stands for “I owe you”. It represents a debt a person owes to another. Unlike barter, IOUs allowed trade to occur without the immediate exchange of goods or services.

- IOUs could be considered as early forms of credit systems.The introduction of IOUs significantly added flexibility in trading and formed the basis for developing modern financial systems.

Money

Finally, money was introduced as a system for interpreting value of an item. Moreover, it resolved the challenges related to the double coincidence of wants and the inadequacy of the IOU system. No longer did people have to hold onto goods until they found someone who wanted them.

The Evolution of money: Timeline

| Period | System |

|---|---|

| Prehistory-6000 B.C. | Barter System |

| 6000 B.C.-1500 A.D. | IOU System |

| 1500 A.D.-Present | Money System |

In conclusion, Barter, IOUs, and Money each represent a critical stage in the evolution of money and trade. At each step, these systems added an element of convenience and efficiency to the process of trade.

Artifacts of Money

The archaeological world has provided us many artifacts that help us understand the evolution of money. These artifacts have evolved throughout history and each tells a different story.

Early Forms of Money

- Barter Systems: Before any form of money was developed, goods were exchanged through a barter system. This system involved exchanging one set of goods or services for another.

- Grain-Money and Food Cattle-Money: In early agricultural societies, grain and cattle were often used as a form of money. In Ancient Mesopotamia, for example, grain was stored in temper-clay barrels and its quantity acted as a unit of account.

- Metal objects: In many societies, small metal objects were used as money, such as bronze knives and spades in Ancient China. The shapes of these objects were often related to their value, with larger and more intricate items being worth more.

The First Coins

The first standardized coins, as we know them today, were created in the ancient kingdom of Lydia (now part of Turkey) around 600 BC. These coins were made from a mixture of gold and silver, and were stamped with images that acted as denominations.

Paper Money

Paper money was first used in China during the Tang Dynasty (618–907 AD). Originally, paper money was just a written promise to pay the bearer a certain amount of coinage, but eventually these notes began to be used as a form of currency in their own right.

Modern Money

Contemporary money includes not only paper currency and coins, but also digital money. The rise of digital transactions has led to the creation of various forms of digital money such as cryptocurrency, most significantly, Bitcoin.

Artifacts of Money by Era

| Era | Forms of Money |

|---|---|

| Pre-Monetary Era | Barter Systems, Grain-Money, Food Cattle-Money, Metal Objects |

| Ancient Era | Coins, Ingot Currency |

| Medieval to Modern Era | Paper Money, Banknotes, Coins |

| Contemporary Era | Digital Currency, Credit Cards, Cryptocurrency |

Emergence of modern economics

The emergence of modern economics is an interesting journey that dates back to ancient times. With the constant evolution of money, the dynamics of economics has significantly changed over the years.

Origins of Modern Economic Thoughts

The modern economic thought started in the 16th and 17th centuries during the period of Mercantilism. This system relied strongly on trade, and it promoted governmental regulation of a nation’s economy for augmenting state power at the expense of rival national powers.

The Classical Era

The classical era of economics took shape in the mid 18th century. During this period, esteemed economists like Adam Smith and David Ricardo introduced concepts like free trade, market competition and capitalist economics.

Significant milestones in Modern Economics Events

| Time Period | Event |

|---|---|

| 16th-17th century | Beginning of Mercantilism |

| Mid 18th century | Era of Adam Smith and David Ricardo |

| 1930 | Introduction of Keynesian Economics |

| 1980 | Advent of Neoliberal Economics |

Keynesian Economics

In response to the Great Depression in the late 1930s, an English economist named John Maynard Keynes introduced a new economic system. Keynes advocated the use of fiscal policy to manage economies and stabilize output.

The Neoliberal Era

- In the 1980s, a new economic philosophy, known as Neoliberalism, emerged.

- This approach emphasized the efficiency of private enterprise, liberalized trade and open markets, and aimed to reduce government intervention in the economy.

Today, the principles of classical economics, Keynesian economics and neoliberal economics dominate the field, with ongoing debates and discussions about the best approaches to achieve social and economic goals.

Economic Theories and Money

Various economic theories explain the evolution and functions of money differently. The most important theories are Commodity Money Theory, Metallist Theory, and Chartalist Theory.

Commodity Money Theory

This theory argues that money has value because it represents a fixed amount of a commodity with intrinsic value. For example, gold coins initially had value because they could be melted down into a set amount of gold.

Metallist Theory

The Metallist Theory, on the other hand, maintains that money originated from the efficiencies of indirect barter. Instead of trading goods and services directly, individuals would indirectly trade by using a common medium of exchange, which is money.

Chartalist Theory

Finally, the Chartalist Theory claims that money’s value comes from its use as a means of payment. This usage creates demand for the money, providing it with value.

Summary

| Theory | Description |

|---|---|

| Commodity Money Theory | Money has value because it represents a fixed amount of a commodity with intrinsic value. |

| Metallist Theory | Money originated from the efficiencies of indirect barter. |

| Chartalist Theory | Money’s value comes from its use as a means of payment. |

Modern Monetary Theory

In the modern world, a combination of these economic theories helps explain the complex nature of money. Two particular theories, Fiat Money Theory and Credit Money Theory, are especially relevant.

- Fiat Money Theory: According to this theory, money has value because the government maintains its value, or because two parties in an exchange agree on its value.

- Credit Money Theory: This theory argues that money is a credit given by a bank, which promises to pay the debt or loan.

In conclusion, the evolution of money is a fascinating and complex tale that reflects the broader growth and development of human civilization itself. From its earliest beginnings as simple barter trade to the innovative digital currencies of today, money has continuously adapted to suit the changing needs and technologies of the time. Understanding this intricate history not only enlightens us about the financial tools we utilize daily but also offers a glimpse into the economic, social, and technological forces that have shaped our world. The story of money is, in essence, a mirror reflecting the progress of humanity.