Overview

Established in 2011, Loansunder 36 is an online lender that helps people access personal loans with attractive interest rates below 36%. This is much lower than the high-interest charges of other debt loan services, giving borrowers more financial freedom and helping them avoid an endless debt cycle. Loansunder36 is an ideal destination for those looking to borrow anything from $1,000 to $35,000 with repayment options varying from 24 to 60 months.

Compare Loansunder36 with Rise Credit

It’s important to compare Loansunder36 and Rise Credit when evaluating online lenders, in order to make an informed decision on which one is best for you. By understanding the differences between them, you can select the right one that meets your requirements. If you’re looking for a personal loan, both these platforms can be of help. However, it is essential to look into the repayment options, interest rates and other determining factors before you make your choice – these aspects may vary from one lender to the other.

Both Loansunder36 and Rise Credit are trustworthy online loan services that offer personal loans for different financial needs. They can help provide you with the financial assistance needed in difficult times. It is important to compare the various platforms with respect to interest rates, fees, loan amounts, repayment terms and credit score requirements before opting for a lender. This will help you make an informed decision while choosing the right lender.

Loansunder36 Requirements. Do you qualify?

In order to be eligible for a personal loan through Loansunder36, you need to meet the criteria outlined by them. These include:

- To be eligible for a loan on Loansunder 36, having a good credit score is necessary. This credit score range isn’t explicitly available but if your rating is above 680, you’re more likely to go through the loan approval process successfully.

- To be approved for a loan, you must have consistent income. This could come from having a job, or running your own business. Loansunder36 may require some evidence of income before they approve the loan, such as pay slips or bank statements.

- To be eligible to borrow, you must be a US citizen or have a valid Green Card or Social Security number.

- To be approved for a loan, applicants must have reached the age of 18 before they can apply for a loan.

- To secure a loan and receive the funds, it is necessary to have a bank account in the borrower’s name. This account must be active and valid.

Loansunder36 offers personal loans to people who meet certain criteria, although meeting these does not guarantee that your loan application will be approved. Additionally, the company may take other aspects into account when examining your application.

Loansunder36 Application process. How to apply?

Obtaining a loan from Loansunder36 is an easy process, which can be done all from the comfort of your own home. You just need to follow these simple steps in order to apply:

- For more information, head over to the Loansunder36 website at loansunder36.com. It’s a great way to find out what they have to offer and how they can help you with your loan needs.

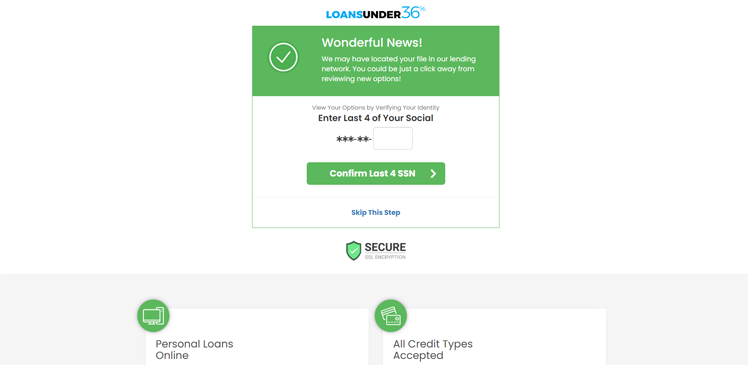

- Get started with the application process by clicking on the “Apply Now” button. You need to submit personal information including your name, address and Social Security number as well as details about your income job history. After completing the online form, you can send in your application.

- After filling out the application form, take the time to review the terms and conditions. Then, click on the “Submit” button to submit your application to Loansunder 36.

- Loansunder36 offers fast loan decisions and if you’re successful, you’ll be presented with multiple loan options with associated terms. An answer will be given within minutes of submitting your application.

- If the terms of the loan are satisfactory, accept and complete signing of the loan agreement to proceed with the transaction.

- Upon signing the loan agreement, Loansunder36 will transfer the loan funds to your bank account within a timeframe of one to two business days.

Applying for a personal loan with Loansunder36 is easy and convenient. Just fill out the online application form and submit the required information to receive a loan decision quickly. The funds will be available in as little as a few business days, making the process even faster.

Summary

Loansunder 36 is a credible online lending platform that provides people with personal loans at reasonable interest rates and flexible repayment terms. People with good credit scores, who are on the lookout for a loan, should definitely think about applying to this platform.