Overview

5KFunds makes it easier for borrowers to compare loans from over 100 accredited lenders. It’s a well-known lending marketplace that can help you secure funding in just one business day, when you’re in urgent need of it. 5KFunds, a subsidiary of Sincerely, LLC, was established in December 2015 and is located in Boca Raton, Florida. Customers from 44 US states have access to the services provided by the company excluding New York, Connecticut, Vermont, West Virginia, Alaska and Georgia.

5kfunds Requirements. Do you qualify?

To be eligible for a loan from 5KFunds, you must meet the following criteria:

- Age: You must have reached the age of 18 or above.

- Citizenship: You must be a U.S. citizen.

- Bank account: You must have an active bank account which is capable of receiving direct deposits.

- Income: Establishing a consistent income is essential for financial stability.

- Contact information: Working contact number and an active email address are required.

- Credit score: You don’t need a certain credit score to access they services.

Possessing the qualifications listed doesn’t automatically guarantee you loan approval from 5KFunds. That said, these prerequisites can give you a higher chance of success in getting your loan application approved.

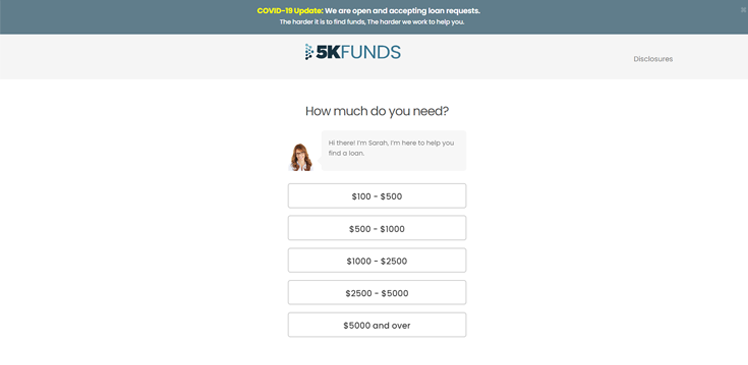

5kfunds Application process. How to apply?

Applying for the loan is simple and straightforward, wasting no time. After approval, the loan amount reaches your account in a flash – no waiting around or wondering when the funds will show up. You can use them as soon as you need them!

If you’re in need of a loan, the process of applying can often feel daunting and time-consuming. Fortunately, applying for a 5KFunds loan is quick, easy, and straightforward. Here’s how you can apply:

- Step 1: Visit the Website

The first step is to visit the 5KFunds website and click on the ‘Get Started’ button. This will take you to the loan application page.

- Step 2: Submit Your Details Next, you’ll need to submit your personal details such as the loan amount required, the repayment term, your employment details, and your banking details. Make sure to provide accurate information to avoid any delays in the loan process.

- Step 3: Verify Your Identity Once you submit your details, you’ll need to verify your identity by entering the last four digits of your Social Security Number (SSN).

- Step 4: Receive Offers After verifying your identity, you’ll receive a list of loan offers that best suit your needs. This makes it easy to compare multiple offers in one place within minutes.

It’s important to note that loan amounts range from $500 to $35,000 depending on the lender, and each loan contract contains different requirements. So, it’s essential that you thoroughly read your agreement before committing.

Compare 5kfunds with Ace Cash Express

5kfunds:

- Loan Amount: $500 – $35,000

- Loan Terms: 1 – 72 months

- APR Range: from 5.99%

- Minimal Credit Score: No minimum credit score required

- Number of States: Operates in 44 states

- Founded: Founded in 2012

Features:

- Competitive interest rates

- Loan amounts starting at $2,000

- Low Annual Percentage Rate

- No penalties for prepayment

- Simple application process

Limitations:

- Not available in NY, CT, VT, WV, AK, and GA

- No online chat feature

- No toll-free helpline for assistance

- Loan Amount: $100 – $2,000

- Loan Terms: 1 – 3 months

- APR Range: 91% – 662%

- Minimal Credit Score: Any

- Number of States: Operates in 23 states

- Founded: Founded in 1968

Features:

- Accessible small loans between $50 and $2,000

- Option to cancel the loan within 72 hours

- Quick and easy online application

- Cash withdrawals available in-store

Limitations:

- Loan amounts vary by state

- APRs are high

- Not all loans are offered in all states

- Not all types of loans are offered in all states

When comparing 5kfunds with Ace Cash Express, here are some notable differences:

Loan Amount:

- 5 kfunds offers a wider loan amount range from $500 to $35,000, while Ace Cash Express provides loans from $100 to $2,000.

Loan Terms:

- 5 kfunds offers longer loan terms of up to 72 months, whereas Ace Cash Express has shorter loan terms of 1 to 3 months.

APR Range:

- The APR range for 5kfunds starts from 5.99%, which is generally lower compared to the higher APR range of 91% to 662% offered by Ace Cash Express.

Credit Score Requirement:

- 5 kfunds does not have a minimum credit score requirement, making it more accessible to borrowers. Ace Cash Express states that any credit score is accepted.

Availability:

- 5 kfunds operates in 44 states, providing broader coverage compared to Ace Cash Express, which operates in 23 states.

Features:

- 5 kfunds emphasizes competitive interest rates, low APR, and no penalties for prepayment, while Ace Cash Express highlights the option to cancel the loan within 72 hours and cash withdrawals in-store.

Limitations:

- 5 kfunds is not available in NY, CT, VT, WV, AK, and GA, whereas Ace Cash Express has limitations on loan availability depending on the state.

- 5 kfunds lacks an online chat feature and toll-free helpline for assistance, while Ace Cash Express does not offer all loan types in all states and has higher APRs.

Overall, 5kfunds and Ace Cash Express have different loan amount ranges, loan terms, APR rates, and availability, along with distinct features and limitations. Consider your specific needs and preferences when choosing between the two lenders.

Summary

In summary, 5kfunds is an established online lender that offers competitive interest rates, a range of loan amounts, and a simple application process. 5kfunds stands out from other lenders as they don’t have a minimum credit score requirement for loan approval. This makes their services available to a wide range of borrowers, thus enabling access to loan funds for people who might otherwise be denied due to low credit scores. Additionally, they operate in 44 states, allowing individuals from various regions to apply for their loans.